Sharp Focus On Fundamental Stock Picking

We focus on what we know and understand. Our conservative and quality-driven process towards comprehensive research and stock-picking helps us concentrate on successfully generating healthy, absolute returns over a long period of time.

We apply a margin of safety to all of our decisions and have a concentrated, high-conviction approach to individual stocks.

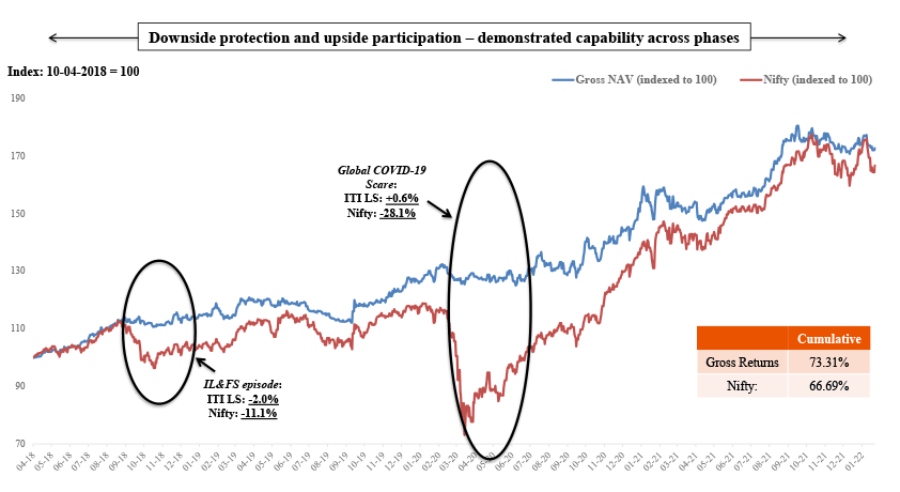

Winning By Not Losing

Simple arithmetic : A 50% loss requires a 100% gain to arrive at starting level of capital; thus it is more damaging to lose money than make it.

Losing less in down years and compounding from a higher level of capital base makes it possible to earn higher compounded equity type returns while taking lower risks.

Larger Canvas For Creating Alpha

Profit from both rising or falling securities thus a larger canvas and a greater opportunity to create alpha as compared to conventional long only funds

Accelerated pace of technology change today is disrupting several businesses leading to their decline; ability to short is a meaningful differentiator, especially for a fundamental, stock picking oriented fund like ours.

Asymmetric Return Profile

Flexibility to reduce equity exposure to overheated/overvalued/declining markets, while increasing exposures in

oversold/undervalued/rising markets results in asymmetric returns profile (ability to participate in rising markets, and yet

protect downside in declining ones (or even better, earn returns even in declining markets due to the flexibility to short).

Helps to lower volatility in performance, lowers capital risks and increases the odds of beating the indexes (or even long

only funds), over a full cycle.

Are developed markets, after one of the longest bull market in history, at risk of sharp declines currently? Ability to

protect capital or even better benefit by shorting, is an advantage for a long-short fund, like ours, in these times.